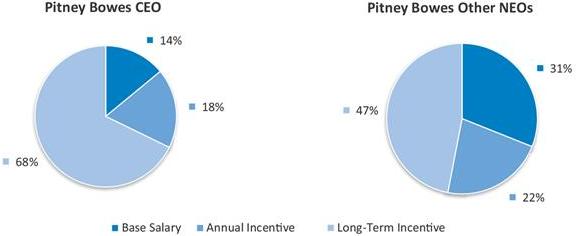

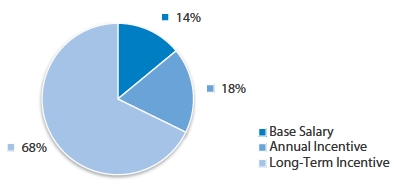

| | Existing Pay for Performance and Strong Pay Governance Practices | • | Strong Pay-for-Performance Practices: | | | • | The overwhelming majority, 86%, of our CEO’s target total direct compensation, is variable, and is subject to financial performance metrics. In addition, 69%71% of target total direct compensation for the other executive officers, is variable, and is subject to financial performance metrics;metrics. | | • | More than two-thirds of the total compensation paid to our CEO, and half of the total compensation paid to the NEOs, is equity-based and aligned with shareholder interests. | | | • | 100% of the 2014 long-term incentive mix is equity-based; | | | • | An independent compensation consultant who reports directly to100% of the committeeannual incentive and performs no other services for the company;long-term incentive program is based on financial objectives; and | | | • | A direct line of communication between our stockholders and the board of directors;The long-term incentive program includes a three-year cumulative TSR modifier. | | • | Strong Pay Governance Practices: | | | • | No employment agreements with our executive officers; | | • | No tax gross-ups on Change-of-Control payments; | | | • | No special arrangements whereby extra years of prior service are credited under our pension plans; | | | • | No perquisites other than limited financial counseling and an executive physical benefit; | | | • | “Double-trigger” vesting provisions in our Change-of-Control arrangements; | | | • | A “clawback” policy that permits the company to recover bonuses from senior executives whose fraud or misconduct resulted in a significant restatement of financial results; | | | • | Prohibitions against pledging and hedging of our stock; | | • | Executive stock ownership policy that aligns executives’ and directors’ interests with those of stockholders, recently expanded to: (i) include more senior executives, and (ii) count only vested shares toward stock holding requirement. | | • | Other Strong Pay Practices: | | • | Separate roles of CEO and chairman of the board of directors; | | | • | An annual risk assessment of our pay practices; | | | • | Significant stock ownership guidelines that align executives’ and directors’ interests with those of stockholders; and | | • | An annual stockholder advisory vote on executive compensation. |

PROPOSAL 3: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

The committee has also acted to make changes in 2013 in accordance with good pay governance, changing market practices and stockholder feedback by eliminating tax gross-ups, reducing severance benefits, providing onlyde minimisfringe benefits and reducing duplicative financial metrics between the annual and long-term incentive plans.

Finally, the committee and the company have made continual efforts to contact stockholders with respect to their thoughts on our compensation structure. Over the past years, the committee has adopted changes in executive compensation that directly relate to comments received from the stockholders.

Key Changes Made to our Executive Compensation Program in 2013

| • | Increased the weighting of financial objectives to 100% for the annual incentive program; | compensation; | | | • | Utilizing as partA direct line of communication between our stockholders and the LTI program a three-year cumulative TSR metric; | board of directors; | | | • | Reduced duplicative metrics across award types by replacingUse of two independent third-party compensation surveys (Radford Survey High-Tech Industry and Towers Watson Regressed Compensation Report) in determining the Adjusted earnings per share financial objective withcompetitiveness of executive compensation; | | • | Use of an Adjusted earnings before interestindependent compensation consultant that advises the Committee directly on the company’s compensation structure and taxes objective in annual incentive; | actions and performs no other services for the company; and | | | • | Enhanced disclosure of performance targets in the 2013 and 2014 proxy; | | | • | Revised our peer group in light of the evolving strategic direction of the company with increasing emphasis in the software and technology arena and to reflect the divestiture of PBMS; | | | • | Restructured the LTI design to be implemented in 2014 awards, making all long-term awards stock based; | | | • | Expanded the executive stock ownership policy to: (i) include more senior executives, and (ii) restrict the shares that will count toward stock holding requirement; | | | • | Introduced the Radford Survey High-Tech Industry in addition to the Towers Watson Regressed Compensation Report in determining the competitiveness of executive compensation; and | | | • | Reduced severance benefits payable on account of a Change of Control from three to two times participant’s annual salary and average annual incentive award and eliminated the excise tax gross-up. | targets. |

We have for the past several years regularly contacted many of our stockholders to give them an opportunity to share their views about our executive compensation program. In additionthe 2014 we reached out to holders of approximately 43% of our outstanding shares to answer questions concerning the changes summarized above, we are maintaining2014 proxy statement, including the existingexecutive compensation practicesprogram. Over the past few years, the Committee has implemented features in the executive compensation program that represent strong corporate governance policies.directly related to comments received from the stockholders. We urge stockholders to read the CD&A beginning on page 3532 of this proxy statement, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the “Summary Compensation Table” and other related compensation tables and narratives on pages 57 through 73,71, which provide detailed information on the compensation of our NEOs. We also invite stockholders to read our Annual Report on Form 10-K for the year ended December 31, 2013,2014, as filed with the Securities and Exchange Commission on February 21, 2014,20, 2015, which describes our business and 20132014 financial results in more detail. In accordance with Section 14A of the Exchange Act, and as a matter of good corporate governance, we are asking stockholders to indicate their support for our NEO compensation by voting FOR this advisory resolution at the 20142015 Annual Meeting: RESOLVED, that the stockholders of Pitney Bowes Inc. approve on an advisory basis the compensation of the company’s named executive officers disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narratives in this proxy statement for the company’s 20142015 Annual Meeting of Stockholders. This advisory resolution, commonly referred to as a “Say-On-Pay” resolution, is non-binding on the board of directors. Although non-binding, our board of directors and the committeeCommittee will carefully review and consider the voting results when making future decisions regarding our executive compensation program. The next “Say-on-Pay” advisory vote will occur at the 20152016 annual meeting.

PROPOSAL 3: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION Vote Required; Recommendation of the Board of Directors The vote on executive compensation is an advisory vote. The affirmative vote of the majority of the votes cast will constitute the stockholders’ non-binding approval with respect to our executive compensation programs. Abstentions and broker non-votes will not be votes cast and therefore will have no effect on the outcome of the vote. The board of directors recommends that stockholders vote FOR the approval of the advisory resolution on executive compensation. Proposal 4: Approval of the Pitney Bowes Inc. Directors’ Stock Plan

Proposal 4: Approval of the Pitney Bowes Inc.

Directors’ Stock Plan, as Amended and Restated

The board of directors recommends that stockholders approve the Pitney Bowes Inc. Directors’ Stock Plan, as amended and restated (Plan). The board of directors unanimously approved the Plan in February 2014. The Plan will become effective May 12, 2014, upon stockholder approval at our annual meeting. The Plan governs grants of stock-based awards to non-employee directors, which is an important component of our non-

employee director compensation program, enabling us to attract and retain persons of outstanding competence to serve as non-employee directors and encouraging the alignment of non-employee director compensation with stockholder interests.

The complete text of the Plan approved by the board of directors is attached as Annex A to this Proxy Statement. The following discussion is qualified in all respects by reference to Annex A.

Why We Believe You Should Approve the Plan

Equity compensation is an essential part of our non-employee director compensation program and enables us to attract and retain persons of outstanding ability. We believe our future success depends on our ability to attract, motivate and retain high quality non-employee directors and approval of the Plan is critical to achieving this success. The potential change in value of the equity compensation to the board members over time directly aligns their interests with the long-term interests of our stockholders.

We believe that we have demonstrated our commitment to sound equity compensation practices. We recognize that equity compensation awards dilute stockholder equity and, therefore, we have carefully managed our equity incentive compensation. In fact, the equity to be utilized under the new Directors’ Stock Plan will be drawn from the Pitney Bowes Stock Plan equity reserve which the stockholders previously approved in 2013. The board targeted its compensation, including the equity component, to be consistent with the market median, and we believe our historical share usage has been responsible and mindful of stockholder interests, as described further below.

Plan Highlights

The Plan provides for automatic annual grants of restricted stock units for non-employee directors.

Awards granted under the Plan will be settled by the issuance of shares of common stock, $1 par value per share, of the company (Common Stock), that are drawn from the shares of Common Stock available for issuance under the Pitney Bowes Inc. 2013 Stock Plan (2013 Stock Plan), previously approved by the company’s stockholders. As has historically been and continues to be the case, however, non-employee directors will not participate in the 2013 Stock Plan. Approval of the Plan will not result in an increase in the number of shares that are available for issuance under our equity compensation plans. As of December 31, 2013, 19,180,600 shares remain available for issuance under the 2013 Stock Plan. Based on our past experience, we believe the previously approved share pool under the 2013 Stock Plan will provide us an opportunity to grant equity awards under the 2013 Stock Plan and the Plan for approximately four more years before we would need to seek stockholder approval of more shares.

Provisions Designed to Protect Stockholder Interests

The Plan has several provisions designed to protect stockholder interests and promote effective corporate governance including:

| • | Limit on grants of awards (specific annual grant amounts are “hard-wired” into the Plan); | | | | | • | Prohibition on share recycling or “Liberal Share Counting” practices (pursuant to the share counting provisions of the 2013 Stock Plan); and | | | | | • | No “evergreen” provision to automatically increase the number of shares issuable under the Plan (shares issuable under the Plan are drawn from the 2013 Stock Plan share pool). |

PROPOSAL 4: APPROVAL OF THE PITNEY BOWES INC. DIRECTORS’ STOCK PLAN

Plan Terms and Conditions

Purpose of the Plan

The purpose of the Plan is to enable the company to attract and retain persons of outstanding competence to serve as non-employee directors of the company by paying such persons a portion of their compensation in stock of the company pursuant to the terms of the Plan.

Plan Administration

This Plan is to be administered by the Governance Committee of the board or any successor committee having responsibility for the remuneration of the directors (hereinafter in this Proposal referred to as the “Committee”).

Eligibility and Participation

Persons who serve as members of the board of directors of the company and who are not “employees” of the company or its subsidiaries are eligible to participate in the Plan. Currently, all of the company’s nine (9) non-employee directors are eligible to, and do participate in, the Plan.

Shares Available under the Plan

Awards granted under the Plan will be settled by the issuance of shares of Common Stock that are drawn from the shares of Common Stock available for issuance from time to time under the 2013 Stock Plan, previously approved by the company’s stockholders. Shares of Common Stock issued pursuant to awards of restricted stock units under the Plan shall reduce, on a one-for-one basis, both (a) the overall maximum number of shares of Common Stock available for issuance under the 2013 Stock Plan and (b) the sub-limit under the 2013 Stock Plan for the number of shares that may be issued for awards that are not options or stock appreciation rights.

As of December 31, 2013, 19,180,600 shares remain available for issuance under the 2013 Stock Plan share pool. In addition to the number of shares described in the preceding sentence, any shares associated with outstanding awards under the prior plans (as defined in the 2013 Stock Plan) as of April 30, 2013 that on or after

such date cease for any reason to be subject to such awards (other than by reason of exercise or settlement of the awards to the extent they are exercised for or settled in vested and nonforfeitable shares) will become available for issuance under the 2013 Stock Plan share pool. Shares delivered out of the 2013 Stock Plan share pool will be authorized but unissued shares of Common Stock, treasury shares or shares purchased in the open market or otherwise. To the extent that any award payable in shares is forfeited, cancelled, returned to the company for failure to satisfy vesting requirements or upon the occurrence of other forfeiture events, or otherwise terminates without payment being made, the shares covered thereby will no longer be charged against the maximum share limitation under the 2013 Stock Plan share pool and may again become available under the 2013 Stock Plan share pool.

Terms and Conditions of Restricted Stock Units Awards

Each non-employee director then serving as a director of the company will receive an annual award on the date of the first meeting of directors after each annual stockholders’ meeting of restricted stock units with respect to a number of shares of Common Stock having a fair market value equal to $100,000; provided, however, that a non-employee director who joins the board after such date will receive a pro-rated award of restricted stock units. Each restricted stock unit granted under the Plan will represent the right to receive one share of Common Stock on the date that is one year following the date the award is granted; provided, however, that with respect to each annual grant the company may, in its sole discretion, provide non-employee directors with the one-time opportunity to elect to defer the settlement of the restricted stock units until the termination of the non-employee director’s service as a director of the company.

Unless the Committee determines otherwise, non-employee directors will have the right to receive dividend equivalents in connection with the restricted stock units

granted under the Plan pursuant to which the non-employee directors will be entitled to receive payments equivalent to dividends with respect to the number of shares subject to the corresponding award of restricted stock units, which payments, unless the Committee determines otherwise, shall be paid to the non-employee directors in cash as and when such dividends are paid to the holders of Common Stock.

Unless the Committee provides otherwise, non-employee directors have no voting or other rights (other than the dividend equivalent rights described above) as a stockholder with respect to the shares of Common Stock subject to and/or issuable pursuant to any awards of restricted stock units granted under the Plan until such shares are actually issued.

The restricted stock units granted under the Plan may not be sold, assigned, pledged or otherwise transferred by the non-employee director, other than by will or the laws of descent and distribution.

PROPOSAL 4: APPROVAL OF THE PITNEY BOWES INC. DIRECTORS’ STOCK PLAN

Adjustments for Corporate Changes

In the event of any change in the number or kind of outstanding shares of Common Stock of the company by reason of a recapitalization, merger, consolidation, dividend, combination of shares or any other change in the corporate structure or shares of stock of the company, the board will make equitable and appropriate adjust-

ments in the number of restricted stock units to be awarded to non-employee directors, in the number of shares subject to and any other affected provisions of outstanding awards of restricted stock units to prevent enlargement or diminution of the benefits intended to be granted under the Plan.

Amendment and Termination

The company reserves the right to amend, modify or terminate the Plan at any time by action of the board, provided that such action will not adversely affect any non-employee director’s rights under the provisions of the Plan with respect to awards that were made prior to such action.

Plan Benefits

As described above, each non-employee director then serving as a director of the company will receive an annual award on the date of the first meeting of directors after each annual stockholders’ meeting of restricted stock units with respect to a number of shares of Common Stock having a fair market value equal to $100,000; provided, however, that a non-employee director who

joins the board after such date will receive a pro-rated award of restricted stock units.

On February 28, 2014, the closing price of our common stock traded on the New York Stock Exchange was $25.45 per share.

U. S. Federal Income Tax Consequences

The following discussion summarizes the material U.S. federal income tax consequences to the company and the participating non-employee directors in connection with the Plan under existing applicable provisions of the IRC and the accompanying regulations. The discussion is general in nature and does not address issues relating to the income tax circumstances of any individual non-employee director. The discussion is based on federal income tax laws in effect on the date of this proxy statement and is, therefore, subject to possible future changes in the law. The discussion does not address the consequences of state, local or foreign tax laws.

Restricted Stock Units

Non-employee directors do not recognize income at the time of the grant of restricted stock units. When the award vests or is paid, non-employee directors generally recognize ordinary income in an amount equal to the fair market value of the restricted stock units at such time, and the company will receive a corresponding deduction.

Vote Required; Recommendation of the Board of Directors

Approval of the Pitney Bowes Inc. Directors’ Stock Plan as amended and restated, requires the affirmative vote of a majority of votes cast. Under our By-laws, abstentions and broker non-votes will not be votes cast and therefore will have no effect on the outcome of the vote. However, for purposes of approval under New York Stock Exchange rules, abstentions are treated as votes cast, and, therefore, will have the same effect as an “against” vote, and broker non-votes are not considered votes cast, and, therefore, will have no effect on the outcome of the vote.

The board of directors recommends that stockholders vote FOR the proposal to approve the Pitney Bowes Inc. Directors’ Stock Plan.

Equity Compensation Plan Information The following table provides information as of December 31, 20132014 regarding the number of shares of common stock that may be issued under our equity compensation plans. | | | | | | | (c) | | | | | | | | | Number of securities | | | | | (a) | | | | remaining available for | | | | | Number of securities to be | | (b) | | future issuance under equity | | | | | issued upon exercise of | | Weighted-average exercise | | compensation plans | | | | | outstanding options, | | price of outstanding options, | | excluding securities | | | Plan Category | | warrants and rights | | warrants and rights | | reflected in column (a) | | (a)

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights | | (b)

Weighted-average exercise

price of outstanding options,

warrants and rights | | (c)

Number of securities

remaining available for

future issuance under equity

compensation plans

excluding securities

reflected in column (a) | | Equity compensation plans approved by security holders | | 14,526,633 | | | $31.78 | | | 19,180,600 | | | | 13,323,075 | | | | $31.14 | | | | 19,715,336 | | | Equity compensation plans not approved by security holders | | — | | | — | | | — | | | | — | | | | — | | | | — | | | Total | | 14,526,633 | | | $31.78 | | | 19,180,600 | | | | 13,323,075 | | | | $31.14 | | | | 19,715,336 | (1) |

| (1) | These shares are available for stock awards made under both the Stock Plan of 2013 and the Directors’ Stock Plan. As of December 31, 2014, of the total 19,715,336 shares remaining and available for future issuance 10,527,654 are available for full value share awards. |

Report of the Executive Compensation Committee The Executive Compensation Committee (Committee) of the board of directors (1) has reviewed and discussed with management the section included below in this proxy statement entitled “Compensation Discussion and Analysis” (CD&A) and (2) based on that review and discussion, the Committee has recommended to the board of directors that the CD&A be included in the company’s Annual Report on Form 10-K for the year ended December 31, 20132014 and this proxy statement. By the Executive Compensation Committee of the board of directors, Eduardo R. Menascé, Chairman

Anne M. Busquet

Anne Sutherland Fuchs

David B. Snow, Jr. Compensation Discussion and Analysis The following discussion and analysis contains statements regarding company performance targets and goals. These targets and goals are disclosed in the limited context of our compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. Investors should not apply these statements to other contexts. Executive Summary Overview This Compensation Discussion and Analysis, or CD&A section explains our compensation philosophy, summarizes the material components of our compensation programs and reviews compensation decisions made by the Executive Compensation Committee (the Committee) and the independent board members. The Committee, comprised of only independent directors, makes all compensation decisions regarding the seven executives identified as Named Executive Officers (NEOs) in the Summary Compensation Table below.below, other than the Chief Executive Officer (CEO). The independent board members, based on recommendations by the Committee, decidedetermine compensation actions impacting the Chief Executive Officer (CEO).CEO. In 2013, the company’s NEOs included two former executive officers (Leslie Abi-Karam and Vicki A. O’Meara) who would have been in the top five highly paid officers had they still been employed by the company at the end of the year (see page 68 for additional details). As a result, there are seven NEOs for 2013:

2014 Named Executive Officers 2013 Named Executive Officers | | | • | Marc B. Lautenbach, President and Chief Executive Officer | | | • | Michael Monahan, Executive Vice President and Chief Financial Officer (effective February 9, 2015, Mr. Monahan was also appointed to the newly created role of Chief Operating Officer) | | • | Mark L. Shearer, Executive Vice President and President, Pitney Bowes SMB Mailing Solutions | | | • | Abby F. Kohnstamm, Executive Vice President and Chief Marketing Officer | | | • | Mark F. Wright, Executive Vice President and President, PB Digital Commerce Solutions1 | | • | Daniel J. Goldstein, Executive Vice President and Chief Legal & Compliance Officer | | • | Leslie Abi-Karam, former Executive Vice President and President, Pitney Bowes Communications Solutions | | • | Vicki A. O’Meara, former Executive Vice President and President, Pitney Bowes Services Solutions |

EffectiveSince December 3, 2012, Pitney Bowes has bifurcated the boardrole of directors elected Marc B. Lautenbach President and CEO and appointedchairman of the board of directors. Marc B. Lautenbach is President and CEO and Michael I. Roth is non-executive chairman of the board of directors.

In his first year as our new President and CEO, Mr. Lautenbach focused on resetting the strategic direction of the company and beginning to execute on that strategy, assembling the right team to lead the company’s critical areas of development over the next several years and beginning to execute on initiatives consistent with the new strategies outlined below. Considering the future prospects of the company, Mr. Lautenbach invested $1,000,000 of his own financial resources in company stock. In addition, two newly hired executive business unit heads also purchased company stock from their own financial resources.

Summary of 20132014 Business Results2 In 2013, the company2014, Pitney Bowes achieved significant success in the early stages of executing onprogress against its strategythree strategic initiatives to transform the company forand unlock shareholder value by 1) stabilizing the future. This success was evidencedmail business, 2) driving operational excellence, and 3) growing its business through expansion in digital commerce. During the year, we continued our financial resultsimplementation of a new go-to-market strategy, divested certain business operations, and attainment of certain objectives targeted at longer-term achievement, including solidifying our balance sheet and divesting businesses no longer in line withinitiated a global effort to streamline the company’s long-term strategy. Our total shareholder return (TSR) forback-office systems. All aspects of our Digital Commerce Solutions segment grew revenue in 2014, including the year was an extraordinary 132%, which placed us fifth in year-over-year TSR among all S&P 500 companies for 2013. We believeintroduction of outbound services from the stock price increase reflected stockholder recognition that our first steps in executing on our new strategy to unlock the value embedded in our company were successful and position us well for the future.United Kingdom. We identified three major objectives for the company that would determine our progress towards transforming our businessesIn addition, we continued to deliver innovative physical and digital products and solutions and made significant progress on each. These objectives wereinvestments in marketing in support of the transformation of our brand. One of the main goals of the re-branding effort is to update the market’s perception of the company. This is the first brand refresh since 1971 and only the third in our 95 year history. The new brand strategy clarifies the company’s role in the changing world of commerce, emphasizing the interplay between physical and digital communications by spotlighting both our traditional strengths in mailing solutions for the small, medium and large enterprises, as follows: (1) stabilize the mailing business; (2) achieve operational excellence;well as our emerging strength in newer technology areas such as location intelligence, customer information management and (3) investcross-border commerce. The new branding launched in growth initiatives.early January 2015.

From a financial perspective: | | • | StabilizeWe returned $152 million to shareholders in dividend payments on Pitney Bowes Common Stock and repurchased $50 million of its own shares. | | | | | • | Total Shareholder Return (TSR) for 2014 was 7.63%, and its two-year TSR calculated as a Compound Annual Growth Rate (CAGR) was 58.23%, placing us at the Mailing Business.The recurring revenue streams in 2013 forvery top of our global Mailing business continued to decline at a slower ratepeer group. When compared to prior years contributing to the overall stabilization of the Mailing business. Equipment salesS&P 500 companies this two-year performance places us in the Production Mail and Small and Medium Business Solutions (SMB) segments improved. Our new go-to-market strategy implementation in the SMB business is improving our sales process and enhancing our client experience, while reducing costs. |

1 | Title effective as of February 2014.96th percentile. | 2 | | | | • | We had our first full year of reported revenue growth since 2008, with an increase of 1% on both a constant currency and reported basis. | | | | | • | The financial results discussed2014 diluted earnings per share from continuing operations were $1.90, compared to $1.81 in this summary are on a GAAP2013. | | | | | • | Earnings before interest and non-GAAP basis. See detailed discussion under the table on page 55 “Accounting Items and Reconciliation of GAAPtaxes were $731 million in 2014 compared to non-GAAP Measures.”$688 million in 2013. |

COMPENSATION DISCUSSION AND ANALYSIS | | • | Achieve Operational Excellence.Our effortsFree cash flow was $571 million in reducing expenses in 2013 resulted in a $71 million savings in selling, general and administrative expenses2014 compared to the prior year. We are$635 million in 2013. This nevertheless was a strong result when factoring in the early stages of implementing a new enterprise resource planning (ERP) system to streamline and consolidate many of our back-office operations. We signed a contract to sell our World Headquarters building in 2014. This is another example of our commitment to reducing operating expenses going forward. In addition, in 2013, we sold three businesses, Pitney Bowes Management Services (PBMS), International Mailing Services (IMS) andcapital expenditures invested into the Nordic furniture business. We sold these businesses because they did not fit within our future strategic intent for the company. We used the net proceeds from the North American portion of the PBMS sale to strengthen our balance sheet by redeeming $300 million in bonds originally scheduled to mature in 2014. Also in 2013, our clear focus on initiatives surrounding inventory and accounts receivables, two key components of working capital, generated over $100 million of cash improvements. | | | | | • | Invest in Growth Initiatives.In 2013, we continued to invest in our e-commerce business which grew revenue sequentially at a high double digit rate. In our software business, we brought in new leadership with skill sets to support our new go-to-market strategy, which we expect will bring revenue growth in the software business. We also moved to increase our investment to 100% effective 2014, in our high growth potential Brazilian joint venture by purchasing our joint venture partner’s interest in the business. |

Turning to our financial performance in 2013, revenue was $3.869 billion compared to $3.915 billion in 2012; however the 1% decrease was more favorable than the year-over-year trend from prior years. Also, we grew revenue in the fourth quarter of 2013, with total revenue of $1 billion representing an increase of 2% over the prior year’s fourth quarter. Adjusted earnings per diluted share from continuing operations for 2013 were $1.88, compared to $1.96 in 2012. Adjusted earnings before interest and taxes were $711 million compared to $744 million in 2012. Adjusted free cash flow for the year was $635 million, and we generated $625 million in cash from operations. Our digital commerce solutions segment experienced higher growth with revenue increasing 3% year over year, including a 17% growth rate in the fourth quarter. Our digital commerce solutions revenue for the year increased from $578 million to $596 million. Our production mail business had an outstanding year due to the growth in its revenue and gross margin. In 2013, we reduced debt on the balance sheet by $671 million compared to year-end 2013. In aggregate, the 2013 financial results were within the guidance the company provided to the investment community.

In addition, in 2013:

| • | We accelerated globalization of key shared service functions including Information Technology, supply chain, service, and client care which will standardize and consolidate key business processes. | | | | | • | We created a single global marketing organization, which will enable us to better serve our clients, leverage our size, and create the foundation to enable us to integrate our organization. | | | | | • | We reorganized our business into three segments: (i) a Digital Commerce solution; (ii) SMB Solution Group; and (iii) an Enterprise Business Solutions Group, which will better align our businesses for which we have a similar strategic intent and will enable us to better serve our clients. | | | | | • | We took important steps to improve our go-to-market capabilities by deepening our specialization in our software business and creating a more robust go-to-market capability in our SMB business. | | | | | | | • | We announced a multi-year licensing agreementreduced debt by $100 million and took additional actions with Twitter, the leading global real-time information network,our debt portfolio to provide location intelligence solutions for its mobile platform. | | | | | • | We announced an interactive digital communications exchange with Broadridge Financial Solutions, Inc. utilizing technology developed by VollyTMthat will make it easier for businesses to communicate with consumers about their most important transactions. This new platform, powered by Amazon Web Services (AWS), enables consumers to securely receive and store comments and manage payments on any participating online channel they choose.create further financial flexibility. | | | | | | | • | We solidified our financial flexibilityreduced sales, general and administrative expenses by strengthening our balance sheet, reducing our dividend payments and implementing key initiatives to reduce our cost structure, working capital and improve our overall efficiency. | | | | | • | We enhanced the company’s existing strong business talent with outside recruits of seasoned executives with critical skills and pertinent experience necessary to lead our company’s transformative development over the next several years.$42 million. |

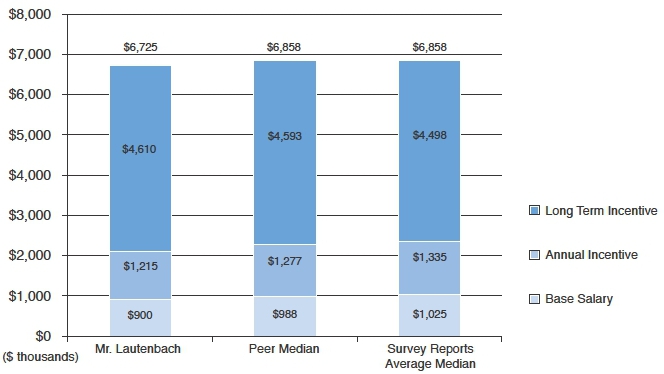

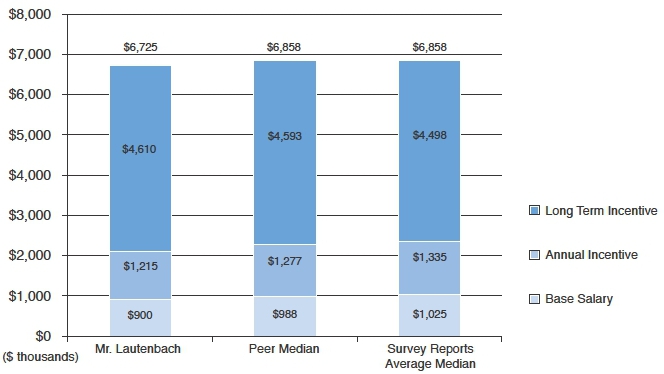

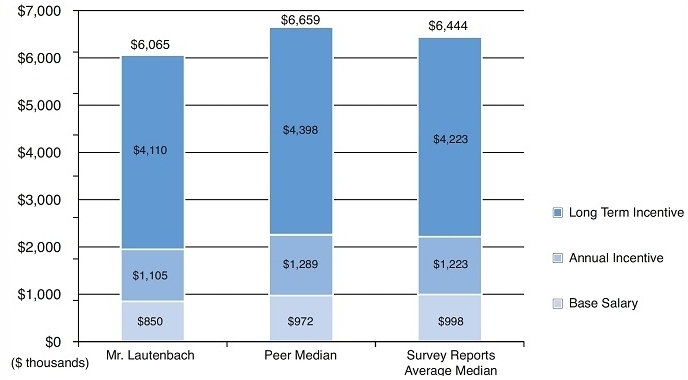

In summary, in 2013, we saw improvingshort, 2014 was a year of significant progress for Pitney Bowes. We continue to see positive trends in our businessbusinesses and made significantare making material progress totoward unlocking the long-term value embedded in our company. Going forward we remain confident about our multi-year journey to transform the company and deliver sustained value for the benefit of our clients, our shareholders and our employees. Some of the amounts in the CD&A portion of this proxy statement are shown on a non-GAAP basis. For additional detail on the calculation of the financialsfinancial results reported, please refer to the table on page 55 “Accounting Items and Reconciliation of GAAP to Non-GAAP Measures”.“Non-GAAP measures.” We urge stockholders to read our Annual Report on Form 10-K for the year ended December 31, 2013,2014, filed with the SEC on February 21, 2014,20, 2015, which describes our business and 20132014 financial results in more detail. CEO 2014 Compensation The compensation package of our President and CEO reflects Pitney Bowes’ enhanced performance-linked pay philosophy and is competitive when compared to our peer group and two third-party compensation survey reports (see description on competitive benchmarking of compensation on pages 50 to 51). The following are characteristics of Mr. Lautenbach’s compensation compared against our peer group, the Towers Watson Regressed Compensation Report and the Radford High Tech Industry Survey (Survey Reports); | | Percentage of median | Percentage of median | | | Peer Group CEOs | Survey Reports CEOs | | Base Compensation* | 91% | 88% | | Total Cash Compensation* | 93% | 90% | | Total Direct Compensation* | 96% | 98% |

| * | See page 40 for definitions of compensation terms. |

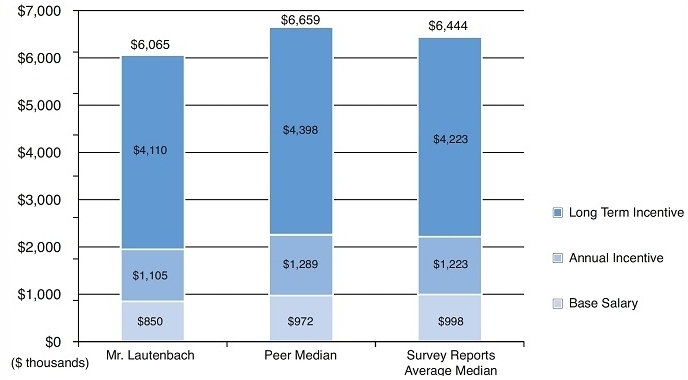

COMPENSATION DISCUSSION AND ANALYSIS CEO 2013 Compensation

The compensation package of our President and CEO reflects the enhanced performance-linked pay philosophy the board adopted in 2012 and further enhanced in 2013 and is competitive when compared to our peer group and two third-party compensation survey reports. Mr. Lautenbach’s total direct compensation is 91% of the market median of total direct compensation for CEOs in our peer group and 94% of the average of the median CEO total direct compensation using the Towers Watson Regressed Compensation Report and Radford High Tech Industry Survey (Survey Reports). Mr. Lautenbach’s base compensation is 87% of the market median of the peer group and 85% of the average of the median of the Survey Reports. His total cash compensation is 86% of the market median of the peer group and 88% of the average of the median of the Survey Reports.

In the above illustration, because the peer median and Survey Reportsthe average median data of the Survey Reports is reported at target, Mr. Lautenbach’s compensation elements are also illustrated at target for comparison purposes. Mr. Lautenbach’s long-term incentive amount includes the value of his one-time sign-on grant of premium-priced stock options, which are amortized over the vesting period of the options. Pitney Bowes CEO

The following highlights 20132014 compensation actions for the President and CEO approved by the board of directors: | | • | Base salary remained atincreased to $900,000 (from $850,000 in 2013 (the board of directors and the Committee approved a freeze of base salaries for the CEO and NEOs in 2013) to bring Mr. Lautenbach closer to market median(1); | | | | | | | • | Annual incentive target remained atincreased to 135% (from 130% in 2013), moving Mr. Lautenbach’s total target cash compensation closer to market median(1), resulting in a payout of $1,209,975$1,519,965 (after applying the Committee-approved 2013 Annual Incentive2014 annual incentive multiplier (see pages 44 and43 to 45 for details)); | | | | | | | • | Long-term incentive target remained atincreased to $4,500,000 (from $4,000,000 in 2013) moving Mr. Lautenbach’s total target direct compensation closer to market median(1), with the February 20132014 grant consisting of 60% Cash Incentive70% Performance Stock Units (CIUs)(PSUs) and 40%30% Restricted Stock Units (RSUs). |

| (1) | Market median is calculated based upon a comparison to the Towers Watson Regressed Compensation Report, the Radford High Tech Industry Survey and the company’s peer group. |

COMPENSATION DISCUSSION AND ANALYSIS Snapshot of 2014 Pay for Performance Actions In making its 2014 compensation decisions and recommendations, the Committee considered the following, among other things: | • | our financial results; | | • | the achievement of the compensation objectives (see discussion beginning on page 43); | | • | our relative and absolute Total Shareholder Return (TSR); and | | | • | stockholder feedback. |

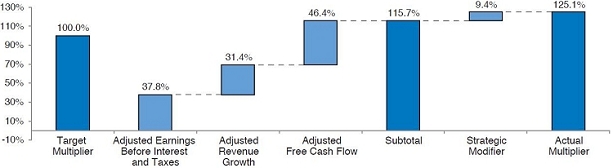

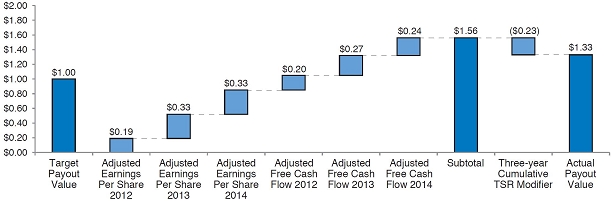

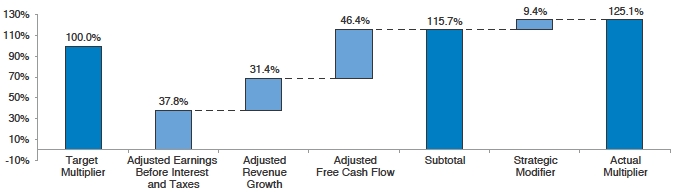

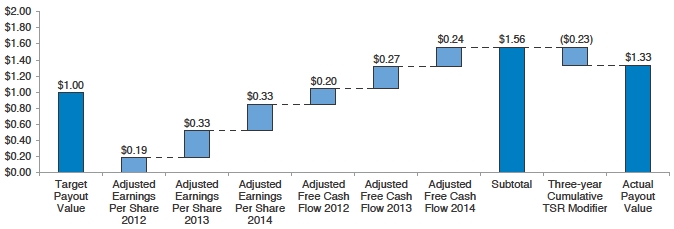

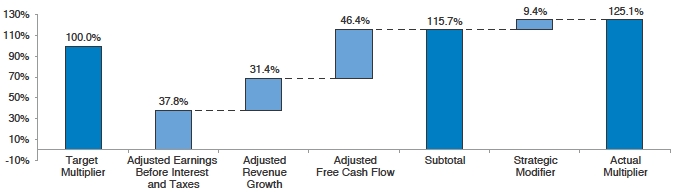

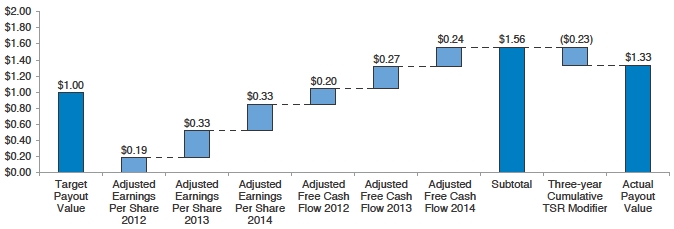

Our 2014 TSR was a solid 7.63%, which followed a 2013 TSR of 132%, resulting in a compound annual growth rate (CAGR) of 58.23% over two calendar years. Pitney Bowes’ two-year CAGR placed it first among its peer group. This illustrates the significant improvement occurring in our businesses over the last two years. Including 2012, the year preceding both Mr. Lautenbach’s tenure as CEO and the initiation of the current three-year strategic plan, our three-year cumulative TSR is 16.99% and places us at the 33rd percentile of our peer group. Based on 2014 financial results, the Committee and independent board members approved an annual incentive payout of 125.1% of target, after application of the Strategic Modifier. For the 2012 – 2014 Cash Incentive Units (CIUs), part of the company’s long-term incentive award, the Committee approved a CIU payout of $1.33 per unit, after application of the TSR Modifier. The following tables compare the actual payouts in 2014 and 2013: | | | 2014 Actual Payout | | 2013 Actual Payout | | Percentage change | | Annual Incentive | | Factor as a % of Target | | Factor as a % of Target | | 2014 vs. 2013 | | Financial Objectives | | | 115.7 | % | | | 100.5 | % | | | | | | Strategic Modifier(1) | | | 9.4 | % | | | 9.0 | % | | | | | | Subtotal | | | 125.1 | % | | | 109.5 | % | | | | | | Total Payout Factor | | | 125.1 | % | | | 109.5 | % | | | 14.2 | % |

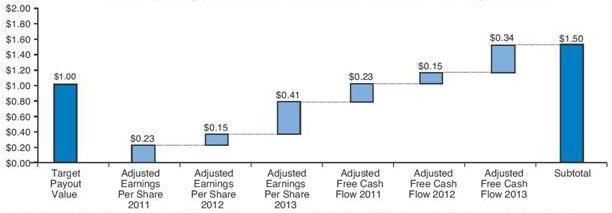

| | | 2014 Actual Unit Payout | | 2013 Actual Unit Payout | | Percentage change | | Long-Term Incentive | | Value (2012 – 2014 cycle) | | Value (2011 – 2013 cycle) | | 2014 vs. 2013 | | Adjusted Earnings per Share | | | $0.85 | | | | $0.83 | | | | | | | Adjusted Free Cash Flow | | | $0.71 | | | | $0.77 | | | | | | | TSR Modifier(2) | | | ($0.23 | ) | | | ($0.10 | ) | | | | | | Subtotal | | | $1.33 | | | | $1.50 | | | | | | | Total Payout Value | | | $1.33 | | | | $1.50 | | | | (11.3 | %) |

| •(1) | The secondstrategic modifier in 2014 included employee engagement, sustainable engagement, client focus and final tranche of a one-time sign-on grant of 400,000 premium-priced stock options was granted in February 2013 with an exercise price equal to 160% of the closing price of company stock on February 11, 2013.team metrics measured from employee survey results. See page 44 for additional details. | | | | |

| | º(2) | The option awards will vest in four equalTSR Modifier for the 2012 – 2014 cycle is a cumulative three-year modifier. The 2011 – 2013 CIU cycle is an annual installments beginningmodifier aggregated each year over the three year cycle. The TSR Modifier modifies the final payout by up to +/– 25% based on December 3, 2013 and ending on December 3, 2016, the fourth anniversarycompany’s TSR as compared to a comparator group. In the 2012-2014 cycle, the comparator group consisted of the grant.company’s peer group. In the 2011-2013 cycle, the comparator group was the S&P 500. The relative TSR modifier for the 2011 – 2013 cycle and 2012 – 2014 cycle was –6% and –15%, respectively. |

For additional detail on the calculation of the financial metrics described above please refer to page 55 “Non-GAAP Measures” and corresponding table. Also see “2014 Compensation” beginning on page 42 of this proxy statement for a discussion of each of the compensation components and the respective payouts. COMPENSATION DISCUSSION AND ANALYSIS Funding of the 2014 Annual Incentive Pool and Payout Multiplier

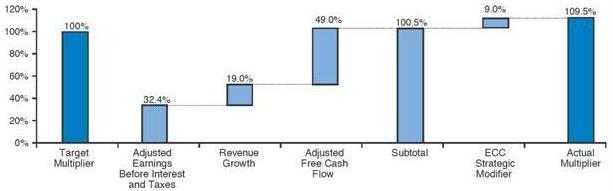

The sum of the metrics may not exactly equal the total due to rounding. For additional detail on the calculation of the financial metrics shown in this chart please refer to the table on page 55 “Non-GAAP Measures.” Funding of the 2014 Cash Incentive Unit Pool and Payout Value

The amounts above include the impact of the Modifier for total shareholder return (TSR). The sum of the metrics may not exactly equal the total due to rounding. The amounts shown in the charts above are based on non-GAAP measures. For additional detail on the calculation of the financial metrics shown in this chart please refer to the table on page 55 “Non-GAAP Measures.” COMPENSATION DISCUSSION AND ANALYSIS Summary of 20132014 Executive Compensation Changes At the company’s annual meeting of stockholders in 2013,2014, stockholders overwhelmingly approved the company’svoted in favor of our executive compensation by a voteover 95% of approximately 93% of the votes cast in favor. During 2013, managementcast. Management and the Committee maintained theirmaintain a commitment to obtaining and considering stockholder feedback on the company’s compensation program by soliciting feedback over the course of the year. Most of the changes in 2013 were made as a result of stockholder outreach and the 2012 Say-On-Pay vote. The following highlights the changes that wewere made to the program in 2014 and in 2013.

KEY COMPENSATION ACTIONS 2014 Implemented new LTI design mix for 2014 awards, making 100% of the long-term awards stock based, with an

allocation of 70% PSUs and 30% RSUs; Rolled out a new executive stock ownership policy to: (i) include

more senior executives, and (ii) restrict the shares that will count

toward stock holding requirement to only vested shares; and Instituted a deferral program to facilitate a quicker path to

executive stock ownership. 2013 Increased the weighting of financial objectives to 100% for the annual incentive program; Enhanced disclosure of performance targets; Revised our peer group in light of the company’s evolving strategic direction with increased

emphasis in software and technology; Reduced severance benefits payable on account of a Change-of-Control from three to two times

annual salary and average annual incentive; and Eliminated the excise tax gross-up. These highlights will be discussed in more detail in “2013the section titled “2014 Compensation” beginning on page 4342 of this proxy statement. | • | Increased the weighting of financial objectives to 100% for the annual incentive program; | | | | | • | Reduced duplicative metrics across award types by replacing the Adjusted earnings per share financial objective with an Adjusted earnings before interest and taxes objective in the annual incentive plan; | | | | | • | Enhanced disclosure of performance targets in the 2013 proxy statement; | | | | | • | Revised our peer group in light of the evolving strategic direction of the company with increasing emphasis in the software and technology arena and to reflect the divestiture of PBMS; | | | | | • | Restructured the LTI design to be implemented in 2014 awards, making all long-term awards stock based; | | | | | • | Expanded the executive stock ownership policy to: (i) include more senior executives, and (ii) restrict the shares that will count toward stock holding requirement; | | | | | • | Introduced the Radford High-Tech Industry Survey Report in addition to the Towers Watson Regressed Compensation Report in determining the competitiveness of executive compensation; and | | | | | • | Reduced severance benefits payable on account of a Change of Control from three to two times the participant’s annual salary and average annual incentive award and eliminated the excise tax gross-up. |

Snapshot of 2013 Compensation Payout Decisions

In making its compensation decisions and recommendation for the 2013 performance year, the Committee considered, among other things, our financial results, the achievement of the compensation objectives (see discussion beginning on page 44), our relative and absolute TSR and the feedback received from stockholders. Our one year TSR placed us at the top of our peer group, while our three year TSR placed us at the 25th percentile, further illustrating the significant improvement that occurred in our businesses in 2013. Based on 2013 financial results, the Committee and independent board members approved an annual incentive payout of 109.5% of target, after application of the Strategic Modifier. For the 2011 – 2013 CIU long-term incentive award, the Committee approved a CIU payout of $1.50 per unit, after application of the TSR Modifier. The following tables compare the actual payouts in 2013 and 2012.

| | | 2013 Actual Payout | | 2012 Actual Payout | | Percentage change | | Annual Incentive | | Factor as a % of Target | | Factor as a % of Target | | 2013 vs. 2012 | | Financial Objectives | | | 100.5 | % | | | 64.0 | % | | | | | | Strategic Objectives | | | n/a | | | | 11.0 | % | | | | | | Payout Modifier | | | 9.0 | % | | | 0.0 | % | | | | | | Subtotal | | | 109.5 | % | | | 75.0 | % | | | | | | Negative Discretion | | | 0 | % | | | (11.0 | %) | | | | | | Total Payout Factor | | | 109.5 | % | | | 64.0 | % | | | 71.1 | % |

| | | 2013 Actual Unit Payout | | 2012 Actual Unit Payout | | Percentage change | | Long-Term Incentive | | Value (2011 – 2013 cycle) | | Value (2010 – 2012 cycle) | | 2013 vs. 2012 | | Adjusted Earnings per Share | | | $0.83 | | | | $0.62 | | | | | | | Adjusted Free Cash Flow | | | $0.77 | | | | $0.80 | | | | | | | TSR Modifier1 | | | ($0.10 | ) | | | ($0.28 | ) | | | | | | Subtotal | | | $1.50 | | | | $1.14 | | | | | | | Negative Discretion | | | $0.00 | | | | ($0.40 | ) | | | | | | Total Payout Value | | | $1.50 | | | | $0.74 | | | | 102.7 | % |

1 | The TSR Modifier for 2011 – 2013 and 2010 – 2012 CIU cycles is an annual modifier aggregated over each three year cycle, which modifies the final payout by up to +/– 25% based on the company’s TSR as compared to the TSR of companies within the S&P 500. The relative TSR for 2010, 2011, 2012 and 2013 was –10%, –25%,–25%, and +25% respectively. |

See “2013 Compensation” beginning on page 43 of this proxy statement for a discussion of each of the compensation components and the respective payouts.

COMPENSATION DISCUSSION AND ANALYSIS

Pay For Performance Alignment

We have designed our compensation program to link pay with performance.

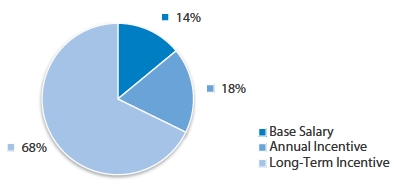

| • | 2013 Program Design.86% of target total direct compensation for our CEO is variable and is subject to performance metrics. In addition, 69% of target total direct compensation for the other executive officers is variable and subject to performance metrics. In 2014, the LTI mix has been changed to 100% equity based. | | | | | • | 2014 Actual Payout.In 2013, in the aggregate, the company exceeded 100% of its financial targets for its annual incentive and long-term incentive plans. | | | |

| | º | Annual incentive.With respect to its annual incentive targets, the company achieved 98% of its Adjusted earnings before interest & taxes target, 105% of its Adjusted free cash flow target and exceeded threshold on its revenue growth target, with fourth quarter 2013 results showing positive revenue growth for the first time in recent years. These results supported a payment for achievement of financial objectives of 100.5% of target. The Committee awarded a 9.0% strategic modifier add-on in connection with the company’s achievement of strategic goals including improved client satisfaction and implementing a culture change. The combination of financial and strategic performances resulted in a payment of 109.5% of target. The previous year annual incentive payout was 64% of target. | | | | | | | º | Long-term incentive.With respect to its long-term incentive targets, the company achieved an average of 110% of target for the Adjusted earnings per share metric and an average of 109% of target for the Adjusted free cash flow metric over the three-year award cycle. This level of performance supported a CIU payout of $1.60 per unit. However, in applying the company’s TSR Modifier, which compares the company’s TSR to the TSR of S&P 500 companies over the three year cycle, the Committee reduced the payout to $1.50 per unit. Although the TSR for 2013 placed us fifth among S&P 500 companies, the TSR applicable to the long-term incentive award for 2011-2013 compares the company’s TSR to the TSR of S&P 500 companies in each of the cycle years. |

COMPENSATION DISCUSSION AND ANALYSIS Executive Compensation Program Structure Compensation Philosophy We link executive compensation to the performance of the company as a whole. We believe executives with higher levels of responsibility and a greater ability to influence enterprise results should havereceive a greater percentage of variable totalperformance-based compensation. Compensation for our NEOs varies from year to year primarily based on achievement of enterprise-wide objectives and individual performance. We emphasize enterprise-wide performance to break down any internal barriers that can arise in organizations that emphasize individual performance. Our executive compensation program is designed to recognize and reward outstanding achievement and to attract, retain and motivate our leaders. In addition, we directly engaged with many of our stockholders in 2013 toWe solicit feedback onfrom our major stockholders regarding our executive compensation program, and management speaks individually to stockholders who wish to provide input. The Committee considers stockholder feedback to determine whether changes to the executive compensation programs are required. The Committee continually reviews the executive compensation programs to ensure they are appropriately alignedproper alignment with stockholder interests. Below is an overview of key aspects of our pay philosophy. | Overall Objectives | • | Compensation levels should be sufficiently competitive to attract and retain talent; | | | • | Compensation should reflect leadership position and responsibility; | | | • | Executive compensation should be linked to the performance of the company as a whole; | | | • | Compensation should motivate our executives to deliver theour short and long-term business objectives and strategy; and | | | • | Compensation packages should be designed to preserve tax deductibility; however, this should not be the sole objective. | | Pay Mix Principles | • | Compensation should be tied to short-term performance and creation of long-term stockholder value and return; | | | • | Performance-based compensation should be a significant portion of total compensation for executives with higher levels of responsibility and a greater ability to influence enterprise results; and | | | • | Incentive compensation should reward both short-term and long-term performance; and | | • | Executives should own meaningful amounts of Pitney Bowes stock to align their interests with Pitney Bowes stockholders. | Pay for

Performance | • | Incentive compensation should reward both short-term and long-term performance; | | • | A significant portion of our compensation should be variable based on performance.performance; and | | | • | The annual and long-term incentive components should be linked to operational outcomes, financial results or stock price performance: | | | | º | Annual incentive compensation is earned only if pre-determined financial objectives are met; | | | | º | Performance-based cash incentivePerformance stock units (PSUs) are earned only if certain financial objectives are met and which can beunits earned are modified plus or minus 25% based on relative performance of the company compared with our peer group over a cumulative three-year period; and | | | | º | Performance-based restricted stock units and cash incentive unitsPSUs are earned only if a threshold financial target is met for IRC 162(m) purposes.met. |

COMPENSATION DISCUSSION AND ANALYSIS Pay Governance Practices We Designbelieve our Compensation Mixexecutive compensation program demonstrates a strong link between pay and performance in its design and exhibits strong governance pay practices. The following lists the principal pay for performance and governance practices adopted by the board. wIndependent Chairman of board of directors wIndependent Compensation Consultant

performing no other services for the company wAnnual stockholder advisory vote on executive

compensation | w100% of annual incentive and long-term

incentive tied to financial metrics w100% of long-term incentive is equity-based w3-year cumulative relative TSR modifier wNo employment agreements with our executive officers wNo special arrangement crediting extra years of

prior service for our pension plans | | Strong

Pay Governance

Practices | | | |

wAnnual risk-assessment of pay practices

wDirect line of communication between board of

directors and stockholders wProhibition against hedging and pledging of stock wEnhanced disclosure of performance targets |

wNo tax gross-ups in change-of-control payments

wDouble-trigger vesting provisions in our change-of-control arrangements wSignificant stock ownership guidelines for senior executives and directors w“Clawback” policy for senior executives |

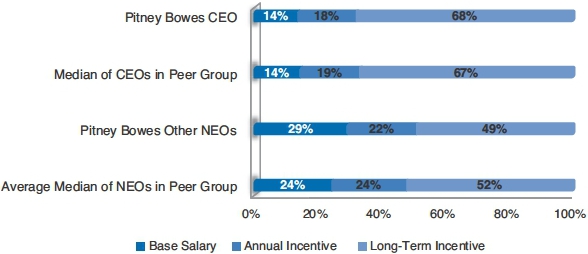

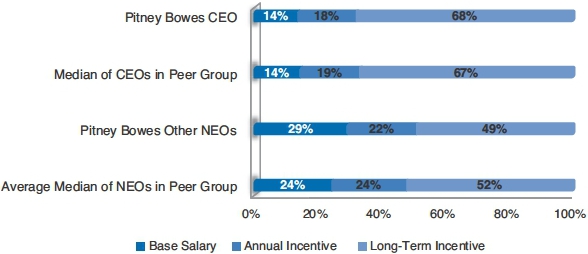

Focus on Variable Pay The chart below shows the 20132014 targeted compensation mix for the CEO and other NEOs compared with the targeted average compensation of our peer group as reported in their 20132014 proxy statements. As illustrated in the chart, our compensation is (i) well aligned to the compensation mix of our peer group and (ii) predominantly variable. The specific proportion of each compensation element below may change with changes in market practicepractices or performance considerations.

This chart does not include special stock option and stock grants made to the CEO and other NEOs upon hire. COMPENSATION DISCUSSION AND ANALYSIS We design the mix of short and long-term incentives to reward and motivate short-term performance, while at the same time providing significant incentives to keep our executives focused on longer-term corporate goals that drive stockholder value. In addition, we believe this balance of short-term and long-term incentive compensation and mix of performance criteria helps mitigate the incentive forto discourage executives to takefrom taking excessive risk that may have the potential to harm the company in the long-term. We monitorreview the compensation structure annually to make sure that it does not incentivizeencourage excessive risk taking and report our findings to the Committee. In determining our executive’s grant levels, we take into consideration the following: internal pay equity;

level of experience and skill;

individual performance compared to established financial, strategic, unit or individual objectives;

market competitive compensation rates for similar positions; and

the need to attract and retain executive talent during this period of transition.

| • | market competitive compensation rates for similar positions; | | • | individual performance compared to established financial, strategic, unit or individual objectives; | | • | level of experience and skill; | | • | the need to attract and retain executive talent during this period of transition; and | | • | internal pay equity; |

Due to the qualitative nature of these considerations, we do not assign specific weightings or numerical goals to them. Overview of Compensation Components The Committee is responsible for determining the compensation for all NEOs, other than the CEO, and for recommending to the board of directors each specific element of compensation for the CEO. The Committee considers recommendations from the CEO regarding the compensation of the other NEOs. The independent board members are responsible for determining the CEO’s compensation. No member of the management team, including the CEO, has a role in determining his or her own compensation. For each NEO, the Committee sets, as a guideline, target total direct compensation levels so the base salary, total cash compensation, and total direct compensation is at +/– 20% of the median of the competitive data based on the Towers Watson Regressed Compensation Report, as regressed for companies approximately our size, and the Radford High-Tech Industry Survey focusing on companies with revenue scopes similar to ours for each position. We describe these two reports in more detail under “Assessing Competitive Practice” beginning on page 5150 of this proxy statement. In order to attract specific talent, the general +/– 20% of the median guideline may be exceeded. For 2013,2014, the total target cash compensation (base salary plus annual incentive) and total target direct compensation (base salary plus annual incentive plus long-term incentive) for Mr. Lautenbach were 88%90% and 92%98%, respectively, of the average of the Survey Reports market median(1)for chief executive officers.CEOs. For the NEOs, as a group, the average total target cash compensation and total direct compensation were 107%105% and 108%110%, respectively, of the average of the Survey Reports.market median(1). | (1) | Market median is the average of the median CEO pay as reported in the Towers Watson Regressed Compensation Report and the Radford High Tech Industry Survey. For NEO pay, market median is the average of the Towers Watson Regressed Compensation Report and the Radford High Tech Industry Survey average median of NEO pay. |

COMPENSATION DISCUSSION AND ANALYSIS The following table outlines the components of direct compensation for our NEOs and how they align with our compensation principles. | | | | How it Aligns | | Fixed or | | Cash or | | What it Rewards | | With Our Principles | | Performance-Based | | Equity | | Base Salary | •

• | Performance of daily job duties

•Highly developed skills and abilities critical to the success of the company | • | •Competitive in the markets in which we operate enabling us to attract and retain executive talent | •

• | •Fixed compensation

•Increases influenced by executive’s individual performance rating | • | •Cash | | Annual Incentive | • | Achievement of pre-determinedpre- determined short-term objectives established in the first quarter of each year | •

•

• | •Competitive incentive targets enable us to attract and retain executive talent

•Payout dependent on achievement of objectives aligning pay to performance

•Subject to a “clawback” (See “Clawback Policy” on page 53 of this proxy statement) | •

•

• | •Performance-based compensation primarily measured on achievement of enterprise-wide metrics

•Individual performance may be considered in establishing executives’ annual incentive opportunity

•Up to a maximum of $4,000,000 per NEO granted under the Key Employees Incentive Plan (KEIP) | • | •Cash | | Long-term Incentives | | | Cash Incentive Units (CIUs) (60% in 2013; eliminated in 2014)after 2013(1)) | •

• | Achievement of pre-determinedpre- determined long-term objectives and annual objectives established in the first quarter of the first year and the first quarter of each year, respectively, of the three year cycle

•Change in company’s stock price versus S&P 500 companies for the 2011-2013 CIU award and versus the company’s peer group for the 2012-2014 CIU award payout | •

•

• | •Payout dependent on achievement of long-term objectives aligning pay to long-term performance

•The resulting unit value is modified by up to +/–25% based on TSR. For the CIU award cycle 2011-2013, the company’sa 3-year cumulative TSR wasas compared to thea 3-year cumulative TSR of companies within the S&P 500. For subsequent CIU award cycles, the comparison is to the company’sour peer group. The application of the TSR Modifier links the CIU payout to stockholder return versus the comparator group of companies. TSR Modifier cannot beresult in a positive adjustment if there is a negative TSR over the three-year cycle

•3-year performance period cycle thereby promotingpromotes retention | •

• | •Performance-based compensation measured on enterprise-wide metrics

•Up to a maximum in any one year of $8,000,000 per NEO granted under the KEIP | • | | •Cash | | (1)There is one more CIU award outstanding, for the 2013-2015 cycle, which will be paid out in 2016. | Performance Stock Units (PSUs) (0% in 2013; 70%(70% in 2014) | •

• | Achievement of pre-determinedpre- determined long-term objectives and annual objectives established in the first quarter of the first year and the first quarter of each year, respectively, ofin the three year cycle

•Change in company’s stock price compared to peer group starting in 2014 | •

• | •Shares vested dependentdepend on achievement of long-term objectives aligning pay to performance

•The resulting number of shares vested is modified by up to +/-25%–25% based on a 3-year cumulative TSR as compared to a 3-year cumulative TSR of our peer group, further linking compensation to stockholder return. TSR Modifier cannot beresult in a positive adjustment if there is a negative TSR over the three-year cycle • 3-year performance period cycle promotes retention | •

• | •Performance-based compensation measured on enterprise-wide metrics

•Up to a maximum of 1,200,000 shares including RSUs per NEO in any plan year granted under the 2013 Stock Plan | • | Equity | | | • | 3-year performance period cycle thereby promoting retention | | | | Equity |

COMPENSATION DISCUSSION AND ANALYSIS | | | | How it Aligns | | Fixed or | | Cash or | | What it Rewards | | With Our Principles | | Performance-Based | | Equity | | | Performance-Based Restricted Stock Units (RSUs) (40% in 2013; 30%(30% in 2014) | | | •

• | Achievement of a pre-determinedpre- determined performance objective established at the time of grant

•Company stock value | •

•

• | •Vesting dependent on achievement of a pre-determinedpre- determined performance objective aligning pay to performance

•3-year pro-rata vesting beginning 2014 thereby promotingpromotes retention for executives; 4-year pro-rata vesting in 2013

executives •Award value linked to company’s stock price | •

• | •Performance-based compensation measured on a threshold financial target for IRC 162(m) purposes

•Up to a maximum of 1,200,000 shares including performance stock unitsPSUs per NEO, in any plan year granted under the 2013 Stock Plan | • | •Equity | Long-term Incentives | | | Market Stock Units (MSUs) (granted only in 2012) | •

• | Achievement of a pre-determinedpre- determined performance objective established at the time of grant

•Company stock value | •

•

• | •Vesting dependent on achievement of a pre-determinedpre- determined performance objective aligning pay to performance and on formula based on TSR over the three-year cycle

•3-year cliff vesting thereby promotingpromotes retention

•Award value linked to company’s stock price | •

• | •Performance-based compensation measured on a threshold financial metric for IRC 162(m) purposes

•Up to a maximum number of shares per NEO (600,000 in 2012), including grants of RSUs, in any plan year granted under the 2007 Stock Plan | • | •Equity | | Periodic Off-cycle Long-term Awards | • | The Committee may also grant other long-term incentive awards in unique circumstances where needed for attracting, retaining or motivating executive talent | • | •All long-term incentives are subject to a “clawback” (See “Clawback Policy” on page 53 of this proxy statement) | • | •Depends on award granted | • | •Cash or Equity |

We also provide certain other benefits for our NEOs, including retirement benefits and deferred compensation plans. For additional information, please see “Other Indirect Compensation” on page 48 of this proxy statement. 20132014 Compensation

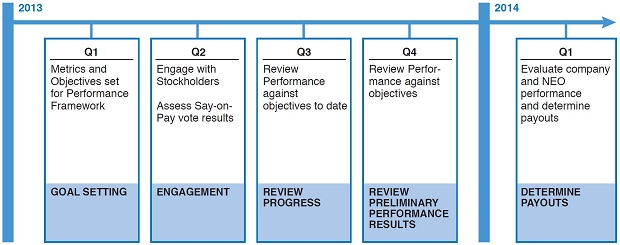

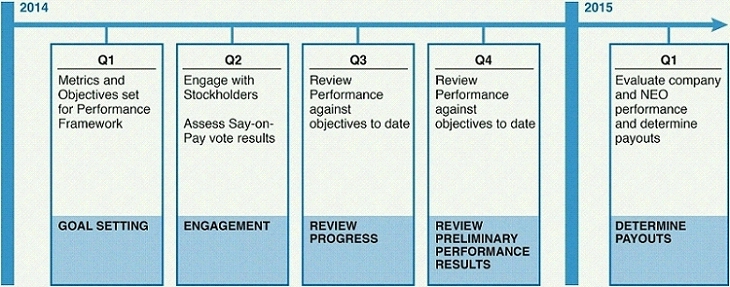

Overview In February 2013,2014, the Committee implemented changes to the compensation program in response to feedback received fromemphasizing further alignment of executive compensation with the company’s stockholders. TheseWe increased the percentage of equity awards in the company’s long-term compensation plan, implemented changes to executive stock ownership requirements, and instituted a deferral program to facilitate a quicker path to executive stock ownership. In addition the company used a net promoter score (a universal metric for client satisfaction) as part of its strategic modifier to the annual incentive program. The strategic modifier can increase the annual incentive pay-out by up to ten percentage points. The changes ensured a stronger link betweenmade in 2014 built on the significant changes the company financial performance and executivemade to its compensation and will be reflected beginning with the February 2014 payouts.programs in 2013.

Base Salary In February 2013,2014, based on the business results for 2012,2013, the Committee and the independent directors frozeincreased the CEO’s base salaries for the CEO and the NEOs. Thesalary by 6%, bringing his company also imposed a freezebase salary closer to market median based on thecompetitive benchmarks. NEOs, excluding CEO, base salaries of the broad-based employee population.salary increases averaged 2.8%.

COMPENSATION DISCUSSION AND ANALYSIS Annual Incentives NEOs are eligible for annual incentives under the KEIP primarily for achieving challenging enterprise-wide financial objectives established at the beginning of each year. Individual performance and its impact on financial, strategic, unit or individual objectives may be considered.

20132014 Annual Incentive Objectives and Metrics

In 2013,2014, 100% of the annual incentive was based on financial objectives which are shown in the chart below. The chart also shows the threshold, target, and maximum ranges. | Financial Objectives | Weighting | Threshold | Target | Maximum | Weighting | Threshold | Target | Maximum | Adjusted Earnings Before

Interest and Taxes(1) | 35% | $673 million | $727 million | $779 million | 35% | $672 million | $718 million | $775 million | | | | | | | | Revenue Growth(1) | 25% | –1.2% | 0.6% | 2.8% | | | | | | | | | Adjusted Revenue Growth(1) | | 25% | –1.0% | 0.5% | 2.0% | | Adjusted Free Cash Flow(1) | 40% | $573 million | $623 million | $673 million | 40% | $400 million | $440 million | $500 million |

| (1) | Adjusted earnings before interest and taxes, Revenueadjusted revenue growth and Adjustedadjusted free cash flow are non-GAAP measures. For a reconciliation and additional information, please see “Accounting Items and Reconciliation of GAAP to Non-GAAP“Non-GAAP Measures” on page 55 of this proxy statement. | | Threshold, target and maximum amounts have been restated to exclude PBMS, IMS, and Nordic furniture.reflect the sale of the Canada DIS business. |

We believe that together these financial objectives effectively measure how well our business is performing on a short-term basis and thus represent appropriate metrics upon which to base annual incentive awards. In 2012 our stockholders expressed concern regardingWe limited the number of duplicative financial metrics in our shortacross annual and long-term compensation programs. In response to that concern, we replaced the earnings per share metric with an Adjusted earnings before interest and taxes metric for the 2013incentives. The 2014 annual incentive program.program includes the following metrics and the reasons why they are important to company performance. Adjusted EBIT is a stronger measure for annual incentive compensation because it more directly reflects current profitability and performance.

Revenue growth is an appropriate measure because it indicates whether our business is expanding.

Adjusted free cash flow is an appropriate measure of the company’s ability to pursue discretionary opportunities that enhance stockholder value.

| • | Adjusted earnings before interest and taxes. This is an appropriate measure for annual incentive compensation because it directly reflects current profitability and performance. | | | | | • | Adjusted revenue growth. This is an appropriate measure because it indicates whether our business is expanding, after excluding the impact of foreign currency translation and the disposal of certain business operations. | | | | | • | Adjusted free cash flow. This is an appropriate measure of the company’s ability to pursue discretionary opportunities that enhance stockholder value. |

Each of these metrics excludeexcludes the impact of certain special items, both positive and negative, which could mask the underlying trend or performance within a business. The adjustments for special items are made consistently year-to-year and are explained on page 55 in “Non-GAAP Measures.” Adjusted free cash flow is the only metric that we use in both our annual and long-term incentive program. We believe that the ability to generate free cash flow allows the company to manage its current financial needs and is central to the company’s future health and ability to take advantage of growth opportunities as they are presented. Free cash flow is also a strong contributor to long-term stockholder value. We set the targets for the Adjustedadjusted earnings before interest and taxes and Adjustedadjusted free cash flow financial objectives at approximatelyclose to the midpoint of our guidance provided to stockholders and the financial community at the beginning of 2013. We set the target for 2013 revenue at the lower end of guidance because we believed achieving that goal would be challenging in light of continuing uncertainties in the core business environment and the transformational changes being made inside the company.2014. The only revision to targets during the course of the year reflected the revision to guidance announced as a result of the sale of PBMS, IMS and our Nordic furniturethe Canada Document Imaging Solutions (DIS) business. We believe that the 20132014 financial objectives at each level (threshold, target and maximum) accurately balance the difficulty of attainment of the level with the related payout. In 2013, we increased the weighting of theThe 2014 annual incentive plan design includes 100% financial metrics, to be 100%, from 70%, of the annual incentive design. This demonstratesdemonstrating our commit- mentcommitment to place more rigor and objectivity in the payoutsestablishing and reflects stockholder feedback. While strategicmeeting our compensation goals. Strategic metrics did not play a primary role in the annual incentive design, we included these important goals(Strategic Modifier) are applied as a zero to 10% modifier to the ultimate payout.compensation payouts by up to ten percentage points. Strategic goals are targets that are important to the successful operation of the enterprise above and beyond financial goals. The strategic goals for 20132014 included improving(i) employee engagement and (ii) client satisfaction andsatisfaction. Employee engagement is meant to measure, through employee surveys, the company’s progress toward implementing a culture change throughouthigh-performance client-oriented culture. Client satisfaction is measured by the organization.implementation and progress made against a net promoter score, a universal metric utilized to measure client satisfaction. These important strategic goals are the foundation for our future business success. Depending on the achievement of the strategic goals, the annual incentive multiplier may be increased by 0% to 10%.success and essential for positive financial results.

Funding of the Annual Incentive Pool and 20132014 Actual Payout Funding of the annual incentive pool begins with the sum of the annual incentive targets of eligible Pitney Bowes Incentive Plan (PBIP) participants. For more information on setting the target see “Assessing Competitive Practice” on page 51.50. After the close of the

COMPENSATION DISCUSSION AND ANALYSIS calendar year, the Committee determines the company’s achievement of the overall financial results against each metric (see above) and approves a multiplier to be applied to the sum of the annual incentive targets. For NEOs, executive officers, unit presidents and staff vice presidents the annual incentive is only paid if the company achieves its IRC 162(m) threshold target of $276,086,000$256,583,000 in income from continuing operations, as restated excluding certain special events. (See “Treatment of Special Events” beginning on page 55 of this proxy statement.) This target was established to allow payments under the annual incentive program to qualify as performance-based compensation for purposes of IRC 162(m) target is an additional target intended to ensure tax deductibility of compensation paid.. Actual 2013 Adjusted2014 adjusted income from continuing operations, excluding all special events, was $380,668,000.$387,414,000. The IRC 162(m)initial threshold targetof adjusted income from continuing operations was restatedadjusted to exclude the PBMS, IMSsale of the Canada DIS business. The adjustment was made according to predetermined definitions when the target was originally established and Nordic furniture businesses sold.is also reflected in actual results. The chart below shows actual financial results and the payout as compared to target.

COMPENSATION DISCUSSION AND ANALYSIS

| Objectives | Target Weighting | Actual Result | Actual Payout as a % of Target | Target Weighting | Actual Result | Actual Payout as a % of Target | | Financial Objectives: | | | | | | | | Adjusted Earnings Before | 35% | $714 million | 32.4% | | | Interest and Taxes(1) | | | | | | Revenue Growth(1) | 25% | (-0.8%) | 19.0% | | Adjusted Earnings Before

Interest and Taxes(1) | | 35% | $731 million | 37.8% | | Adjusted Revenue Growth(1) | | 25% | 1.6% | 31.4% | | Adjusted Free Cash Flow(1) | 40% | $655 million | 49.0% | 40% | $467 million | 46.4% | | Total | 100% | n/a | 100.5% | 100% | n/a | 115.7% |

| (1) | For compensation purposes, (a) adjusted earnings before interest and taxes excludes the impact of foreign currency translation; (b) adjusted revenue growth excludes the impact of foreign currency translation and the disposal of certain business operations; and (c) adjusted free cash flow excludes reserve account deposits and changes in finance receivables. Adjusted EBIT, Revenueearnings before interest and taxes, adjusted revenue growth and Adjustedadjusted free cash flow are non-GAAP measures. For a reconciliation and additional information, on the adjustments, please see “Accounting Items and Reconciliation of GAAP to Non-GAAP“Non-GAAP Measures” beginning on page 55 of this proxy statement. |